Quantum Computing and the Future of Crypto Security

Quantum Computing If you’ve been in crypto for more than five minutes, you’ve probably seen the new fear headline making

Crypto Basics June 24, 2025

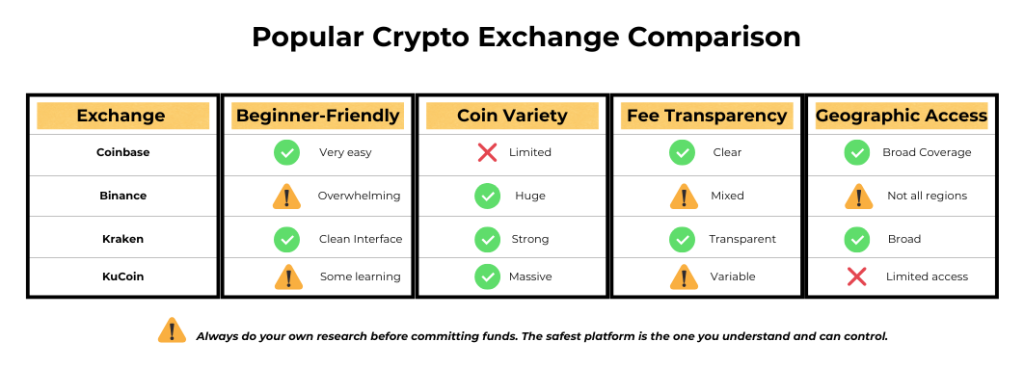

Thinking about signing up for a crypto exchange?

Pause. This one choice sets the tone for everything that comes next.

Pick wrong and you could waste time, lose access to your funds, or worse. Beware of crypto exchange mistakes.

Crypto exchanges love to market themselves as “safe,” “low-fee,” and “beginner-friendly.” But the fine print tells a different story, and most people don’t even know what to look for until something goes sideways.

This blog is your heads-up. It’s not everything, but it’s what you need to know before you create an account and start moving money around.

You only get one chance to set things up the right way. Get it wrong now, and you could spend months untangling problems, or worse, lose access to your crypto. The Jumpstart PlayBook shows you how to start the safe way, from the very first move and avoid costly crypto exchange mistakes.

What a crypto exchange really is (and isn’t)

Where beginners go wrong before they even trade

What hidden risks most users overlook

Why using multiple exchanges can be smart, but dangerous if done wrong

What to check before trusting any platform with your money

A crypto exchange is your access point into the world of digital assets.

But not all access points are equal.

Some are well-known, regulated, and beginner-friendly. Others are obscure, restrictive, or flat-out risky. There are exchanges that hold your hand, and exchanges that leave you wide open.

You might’ve heard terms like “centralized” and “decentralized.” That distinction matters, but not the way most make it sound.

What matters more? Who controls your funds, what you can access, and what happens when something goes wrong.

Most crypto exchange mistakes aren’t made during a trade. They’re made during set-up when you choose the wrong platform, check the wrong box, or ignore something that didn’t seem important at the time.

Here’s the truth:

What looks easy upfront can turn costly down the line.

That “low-fee” platform? Might bury you in hidden charges.

That shiny interface? Could block you from the coins you actually want.

That quick sign-up? May lock your account when you try to withdraw.

Most people don’t realize any of this until it’s already cost them time or money.

The Jumpstart PlayBook was created to prevent all of this. It doesn’t just help you get started, it helps you start smart so you’re not back-tracking later trying to fix things you didn’t know you messed up.

Security isn’t just about passwords. It’s about what the platform does to protect your funds and whether you’d even know if something was off.

Some exchanges are open about their protections. Others make you dig. And then there are the ones that sound secure but aren’t.

If you don’t know what to look for, you’re trusting a platform blindly. And in crypto? Blind trust is a liability.

Sure your wallet’s secure? So was everyone else… until their crypto disappeared. The Ultimate Wallet Security PlayBook breaks down the risks hiding in plain sight – the ones your exchange won’t mention, your wallet won’t warn you about, and you won’t notice until it’s too late to stop them..

You could sign up for a popular exchange today only to find out tomorrow that your country blocks half of its features.

Some platforms have regional limitations. Some restrict tokens. Some freeze entire accounts based on local laws.

None of this is front and center on their homepages.

You need to know how to read between the lines, or better yet, how to avoid platforms that play games with your access.

That’s a question most people don’t even think to ask.

And yet, the answer quietly separates casual users from people who actually understand how to play this space right.

The short answer: yes.

But not for the reasons you’ve seen on Reddit or in that YouTube video someone shared with you.

There are advantages to spreading things out, but also ways to do it wrong.

Sloppy set-ups create security gaps and headaches. Smart set-ups create options and avoid crypto exchange mistakes.

The Jumpstart PlayBook shows how to build your foundation for flexibility, without creating a mess or putting your funds at risk.

It’s one of the biggest traps and the most common.

You buy crypto. It sits in your account. Everything looks fine.

Until it’s not.

Maybe withdrawals get restricted. Maybe the platform goes down. Maybe you get locked out.

And suddenly you realize… you never really had control.

Think your crypto’s safe just because it’s in a wallet? That false sense of security has cost people more than they expected. The Ultimate Wallet Security PlayBook shows you what most miss and how to lock things down before it’s too late.

Q: Should I use more than one crypto exchange?

A: Most beginners start with just one, but experienced users often diversify. It’s not about complexity, it’s about access, safety, and flexibility. The key is knowing how to manage it without exposing yourself to unnecessary risk.

The Jumpstart PlayBook walks you through setting up your exchange foundation the right way from the start.

Q: Is it safe to leave my crypto on an exchange?

A: It might seem fine, until it’s not. Exchanges can freeze withdrawals, get hacked, or go offline. If you don’t hold the keys, you don’t fully control your crypto.

The Ultimate Wallet Security PlayBook shows you how to move your assets into your control and protect them long-term.

Q: What should I look for in a crypto exchange?

A: Reputation. Real security measures. Clear fees. Good liquidity. And simple tools you understand. Not all platforms are built with you in mind, some are built to trap you with hidden limitations.

Can you really afford to lose everything? The Crypto Cracker PlayBooks fill the gaps before they become disasters.

As the CFPB data shows, nearly 40% of crypto-related complaints involve fraud or scams, while many others stem from frozen accounts or missing funds.

Quantum Computing If you’ve been in crypto for more than five minutes, you’ve probably seen the new fear headline making

New to crypto? Start here. Chill the F*ck Out If your blood pressure spikes every time Bitcoin sneezes, congratulations, you’re